What business models support great learning games? Not just any edutainment video game, but the kinds of immersive, fully-realized experiences coming out of places like the ASU Center for Games and Impact or MIT’s Learning Games Network. These aren’t shovelware with shoehorned content. They are games in which the fun is the learning. It’s an art as much as a science, and that means they require significant investment – more than seems sustainable from where many of us stand.

This question about business models arises whenever game-based learning organizations talk, and it surfaced again at a recent gathering of the Gates Foundation’s Games for Learning and Assessment portfolio. A seminal study we drew from is the Games and Learning Publishing Council‘s (also Gates-funded) deep market analysis of the learning games space, with particular focus on barriers to marketing and selling games into the K12 space. This analysis of the market prospects for learning games also touched on barriers to investments in this space, particularly the reluctance of venture capital to enter.

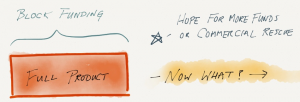

In a breakout group focused on the topic of sustainability, we honed in on a subset of the overall issue: how to fund new product lines. This isn’t the same question as how to create sustainable businesses, but R&D operations are key to our business models. And typically, this is what the existing process looks like:

At the “Now What?” phase, we usually see a few options:

- The product is incomplete, and we scramble for more funding to finish or fix it. During this time, the product isn’t evolving.

- The product is great, but the revenues it generates is inadequate to underwrite marketing, sales, support, patches, upgrades, data analysis, etc. Even if it’s educationally successful, it’s a commercial failure, at least not without further investment.

- The product is great, and it’s commercially viable.

Anyone who’s familiar with the Lean Startup model would recognize the above model as broken. Too much is risked on that first investment, and not enough is there to support iteration, nevermind total pivots. Worst of all, while user testing may be happening, market testing is not.

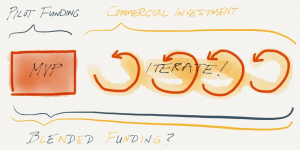

So what’s the alternative? This is what we sketched:

In this model, we put out a smaller product faster and, importantly, begin commercialization efforts sooner. In the perfect case, we find commercial partners early to invest in the product. The benefits: we fail faster, and commercial viability is a factor in that earlier success/failure evaluation.

The upshot would be many more pilots, many more failures, and a bit fewer fully-developed games – but those that do survive are already tested for market viability.

Now the reality for a lot of nonprofits is that we’re rarely in a situation where our investors (typically, philanthropic grantmakers) are in a position to support a pure form of this model. Often, grants have rigid requirements and timelines, and the high cost of securing and reporting on grants incentivizes grabbing the biggest grant possible as quickly as possible.

After this gathering, I realized that a few changes would make the MVP model a lot more viable for many of us:

- Grantmakers could deliberately underwrite MVPs, ideally with a commitment to support winners. This is exactly what the Gates Foundation did with its recent literacy courseware challenge. More of this kind of investing needs to happen.

- Large grants could have longer execution periods to allow us to structure product development in stages and go through multiple iterations.

- Both grantmakers and grantseekers should realistically budget for market testing and iteration.

- Commercialization should begin sooner in a product’s lifecycle.

Of course, suggestion 4 begs an overarching question. We could individually or as a consortium retain more business development talent and create more commercial alliances. But as we continue to forge ahead on the supply side of the learning games market, the question that remains is whether the demand is there to sustain us.